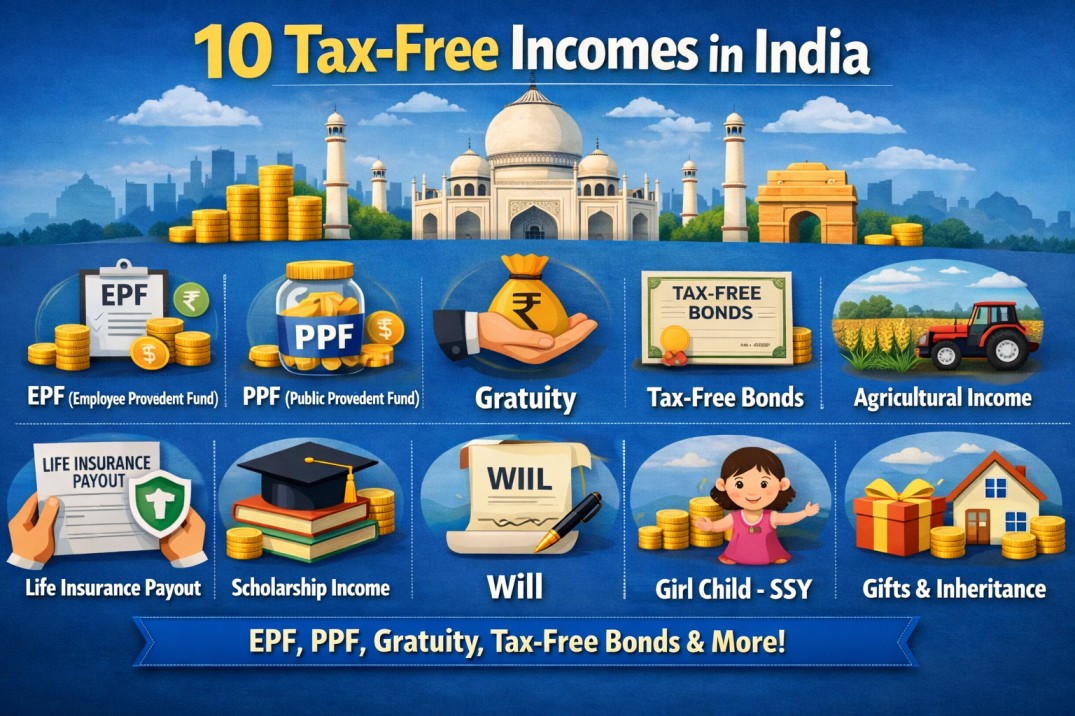

Tax planning is one of the smartest financial habits for long-term wealth creation. In India, several income sources are either fully tax-free or enjoy major tax exemptions under current income-tax rules. Knowing these options can help you legally reduce your tax burden while building secure savings for the future.

Why Understanding Tax-Free Income Matters

Many taxpayers focus only on deductions, but tax-free income is even more powerful.

It helps you:

- Increase real take-home returns

- Reduce overall tax liability legally

- Build long-term wealth without extra tax pressure

- Improve retirement and emergency planning

When used correctly, these instruments create stable, risk-balanced, and tax-efficient portfolios.

1. Employees’ Provident Fund (EPF)

EPF is one of the most popular retirement savings tools for salaried employees.

Tax Benefits

- Employee contribution qualifies for deduction under Section 80C.

- Interest earned is tax-free (subject to limits).

- Final maturity withdrawal is fully tax-free after continuous service conditions.

Why It Matters

EPF combines safe returns, disciplined savings, and complete tax exemption, making it a core retirement asset.

2. Public Provident Fund (PPF)

PPF is a government-backed long-term investment known for safety and tax efficiency.

Tax Advantages

- Investment eligible for Section 80C deduction.

- Interest earned is completely tax-free.

- Maturity amount after 15 years is also tax-free.

Best For

- Conservative investors

- Long-term wealth creation

- Retirement and child education planning

PPF follows the EEE (Exempt-Exempt-Exempt) tax model, which is extremely beneficial.

3. Gratuity Received from Employer

Gratuity is a retirement benefit paid to employees after completing a minimum service period.

Tax Rules

- Government employees: Fully tax-free.

- Private employees: Tax-free up to the prescribed limit under income-tax laws.

Financial Importance

Gratuity acts as a retirement cushion and reduces dependence on other savings.

4. Tax-Free Bonds

Tax-free bonds are issued by government-backed institutions to raise funds for infrastructure projects.

Key Benefit

- Interest earned is completely tax-free, unlike bank fixed deposits.

Who Should Invest

- Investors in higher tax brackets

- Those seeking stable, long-term income

- Low-risk portfolio planners

These bonds provide predictable returns with zero tax on interest, making them highly attractive.

5. Life Insurance Maturity Proceeds

Money received from a life insurance policy after maturity or claim settlement is generally tax-free.

Conditions

- Premium amount must be within allowed percentage of the sum assured.

- Policy must comply with income-tax rules.

Why It Helps

Life insurance offers financial protection plus tax-free maturity wealth, making it a dual-purpose tool.

6. Agricultural Income

Income earned from agricultural activities is fully exempt from tax under current laws.

Includes

- Crop cultivation income

- Farm rent or revenue

- Sale of agricultural produce

Important Note

Though tax-free, it may be considered for rate calculation in some cases.

7. Gifts Received from Relatives

Certain gifts are completely tax-free if received from specified relatives.

Tax-Free Situations

- Gifts from parents, spouse, siblings, or lineal relatives

- Gifts received during marriage

- Inheritance through will or succession

This rule supports family wealth transfer without tax burden.

8. Scholarship Income

Scholarships granted to meet education expenses are fully tax-exempt.

Covers

- Government scholarships

- Private or institutional scholarships

- Research fellowships for education

This ensures students can focus on learning without tax worries.

9. Leave Travel Allowance (LTA)

LTA helps salaried employees save tax on travel expenses within the country.

Exemption Rules

- Valid for domestic travel only

- Available for a limited number of journeys in a block period

- Covers travel fare, not hotel or food costs

Proper planning can turn routine vacations into tax-saving opportunities.

10. Retirement Commuted Pension

A portion of pension withdrawn as a lump sum at retirement may be tax-free.

Tax Treatment

- Fully tax-free for government employees.

- Partially exempt for non-government employees based on gratuity status.

This benefit provides immediate liquidity after retirement without heavy taxation.

Smart Tips to Maximize Tax-Free Income

To fully benefit from tax-exempt earnings:

- Combine EPF, PPF, and insurance for long-term EEE benefits.

- Use tax-free bonds for steady passive income.

- Maintain proper documentation and eligibility proof.

- Plan investments before the financial year ends.

- Review updated tax rules annually.

Strategic planning ensures higher savings with zero legal risk.

Final Thoughts

Tax-free income sources are powerful tools for financial security, retirement stability, and wealth growth. By understanding these 10 options—EPF, PPF, gratuity, tax-free bonds, insurance maturity, agricultural income, gifts, scholarships, LTA, and pension commutation—you can significantly reduce taxes while increasing long-term returns.

Smart taxpayers don’t just earn more—they keep more through legal tax planning. Start organizing your tax-free investments today to build a stronger, stress-free financial future.